No matter how you look at it, budgeting is tricky.

When you get it right, you’re an absolute genius. But when you get it wrong, things can get very messy.

So how do you avoid the latter? You choose a budgeting process that suits your organization.

Top-down budgeting is a budgetary system that can bring financial clarity to your company. And, perhaps, make you look like a genius.

While it won’t make budgeting any less tricky, it will give you control over company spending.

In this article, we’ll examine the following:

- What is top-down budgeting?

- The process of top-down budgeting

- Pros and Cons of top-down budgeting

What is top-down budgeting?

Unlike bottom-up budgeting, top-down budgeting is a financial process in which executives decide a company’s budget.

Top-down budgeting is a very traditional budgeting approach. It goes a little like this: a team of executives sits around a long table to discuss the company’s goals. After too much coffee, a few laughs, and some much-needed debates, they agree on a budget for the coming month, quarter, or year.

Top-down budgeting is a very traditional budgeting approach. It goes a little like this: a team of executives sits around a long table to discuss the company’s goals. After too much coffee, a few laughs, and some much-needed debates, they agree on a budget for the coming month, quarter, or year.

Before handing the budget to middle managers, executives divide the budget for each department. In turn, middle managers work their way down the corporate ladder, setting budget limits for their teams.

Let’s use the marketing department of a midsize company, for example.

In a top-down structure, the marketing director is handed down a budget to meet goals for an upcoming period. It’s then the marketing director’s job to allocate funds within the marketing department.

Here are some of the teams they must consider:

- Product Marketing

- Advertising

- Social Media

- Acquisitions

- SEO

- Content Creation

- Web Design

It’s the marketing manager’s job to allocate funds using past performances, upcoming plans for growth, and future goals. They will then hand down the allocated budget to managers from the above teams. In turn, team managers must meet goals using their assigned budget.

The Process of top-down budgeting

While we drew a rather crude picture of the top-down budgeting process above, much more goes into it.

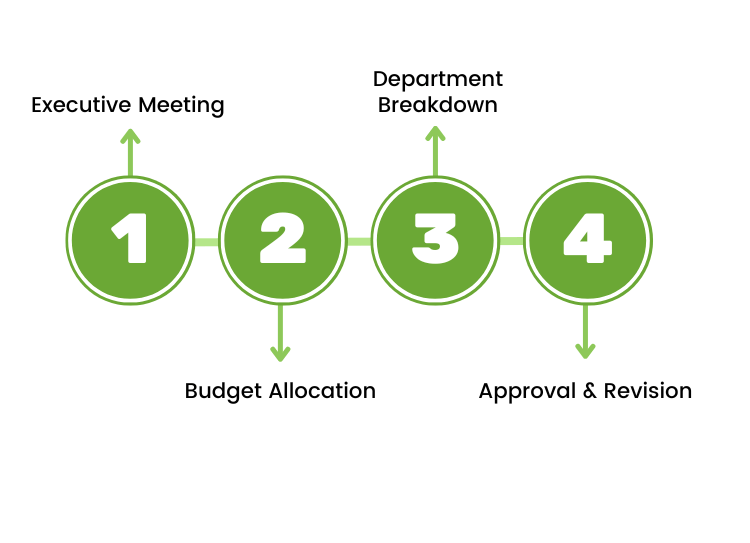

We’ve broken down the top-down budgeting process in four steps:

1. Executive Meeting

Senior management meets to discuss past performances and projected goals. Together they examine projected sales, expected profits, and expenses. They analyze past marketing campaigns and explore how to drive growth.

The final numbers are passed down to the finance department for approval.

2. Budget Allocation

The financial department makes the budget allocations based on the senior management meeting. They weigh in on goals, consider past allocations, and explore future endeavors.

For example, if senior management plans to restructure the company website and launch a new product, marketing will likely get a budget increase to cushion the investment.

3. Department Breakdown

Department managers receive a spending limit for a set period. Now it’s their job to allocate their spending based on their individual department goals.

It often includes:

- Salaries

- Hiring outside help

- Advertising campaigns

- Events

- Office equipment

- Software/Tech

4. Approval & Revision

You then submit your findings to the stakeholders for approval. But before that, the budget estimations should be examined closely to make sure that there aren’t any discrepancies.

What Next?

Once the numbers are set, all that’s left is to input them somewhere. One way to do that is to use Excel spreadsheets. A better way is to use something that’s more advanced and user-friendly.

MARMIND is one of the best tools on the market to plan your top-down budget. Ranked as a strong performer in the 2022 Forrester Wave Report, Marmind lets you set limits across organizational units and regions, track your favorite KPIs, monitor performance in real time, optimize your marketing process, and more.

Pros of Top-down budgeting

Top-down budgeting is an effective budgeting strategy that can help a company limit its spending. Executives decide how money is spent to keep the company afloat and promote growth. The power is at the top of the ladder, keeping a strict hierarchy and a clear understanding of the chain of command.

This structure takes a lot of stress off the shoulders of middle management and is quick to decide and adjust if necessary.

At a glance, here are some of the pros of top-down budgeting:

- Senior managers are involved with organizational growth

- Looks at the big picture

- Saves time for lower management

- Easy to calculate

- Less time consuming

Cons of top-down budgeting

Because it looks at budgeting from a bird’s eye view, top-down budgeting is often unrealistic. It doesn’t consider the day-to-day operation of a company and doesn’t take the needs of individual workers into account.

It’s a rather cold approach that doesn’t involve the entire company. Middle and lower managers are not part of the budgeting process, making them less involved in company decisions. That in itself can have a negative impact on employee satisfaction.

The cons of top-down budgeting:

- Less accurate than bottom-up structure

- It may not be realistic

- Doesn’t help promote company culture

- Doesn’t involve the whole company

- Doesn’t examine day-to-day operations

Last thoughts

Top-down budgeting is a traditional financial structure. It allows senior managers to set the budget according to company goals. With top-down budgeting, the company’s chain of command is respected, making clear who the decision-makers are.

When done well, top-down budgeting will avoid overspending and drive company growth.